Your Financial Intelligence, Powered by AI

Connect your bank accounts with bank-level security, ask questions in plain English, and get instant insights with ML-powered fraud detection—all encrypted and secure in real-time.

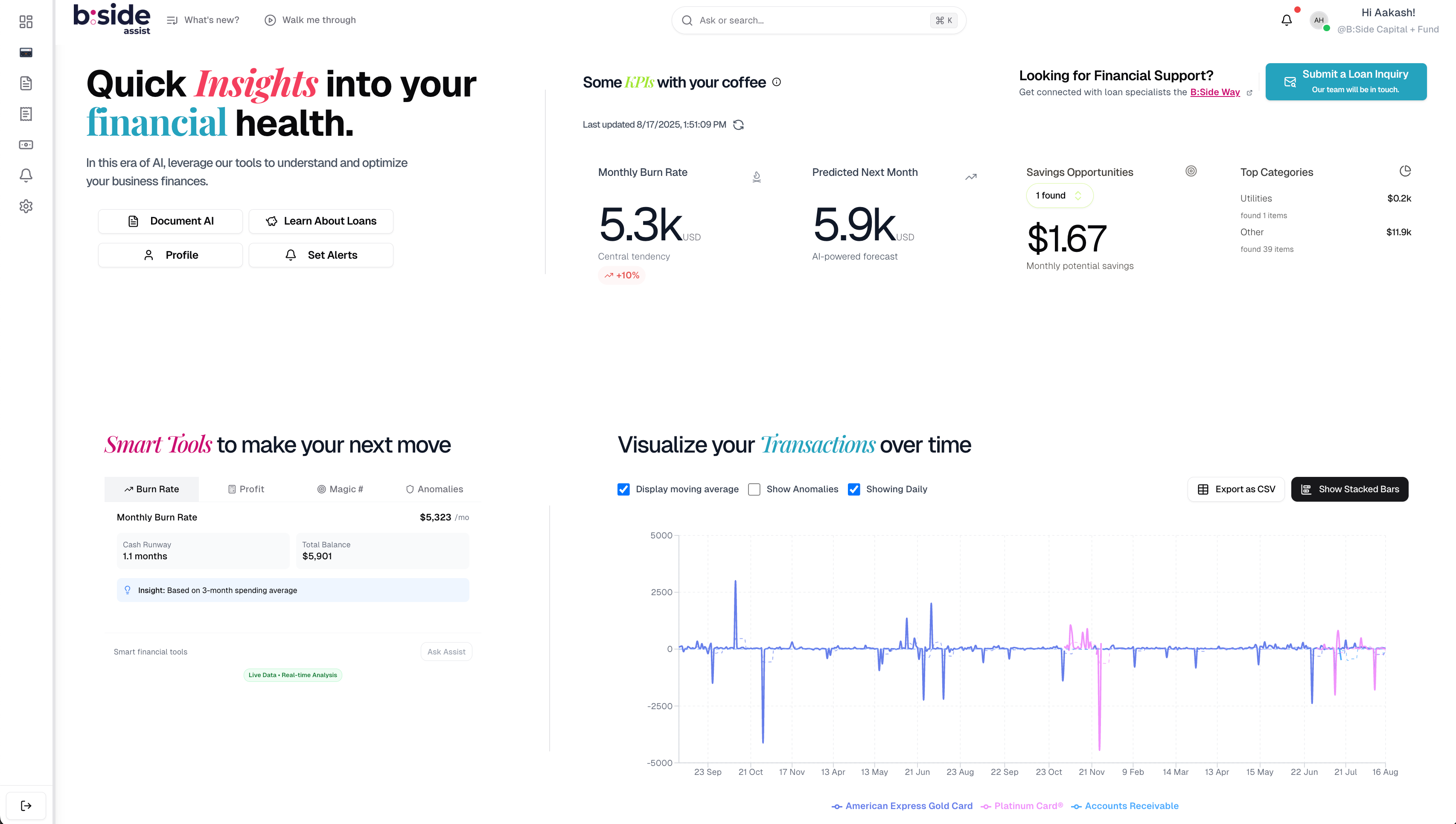

B:Side Assist transforms how businesses manage their finances with enterprise-grade security. Our secure AI assistant answers questions like "show my spending by category this month" and generates visual charts instantly. With 11,734+ transactions analyzed and 305 trained fraud detection models, we deliver encrypted, enterprise-grade financial intelligence without the complexity.